What are cross-border transactions?

Cross-border transactions are transactions made with bank cards with a destination outside the Republic of Moldova. This not only includes transactions performed using the actual card (ATM cash withdrawal, payments in stores using POS terminals), but also purchases made online or abroad

How are card transactions processed abroad?

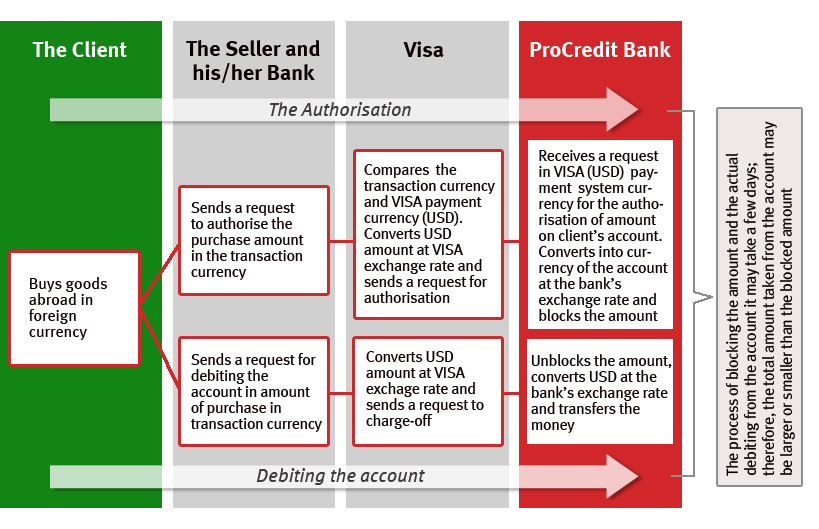

Transactions are carried out in two steps: the authorisation of funds and the actual debiting of the funds from the account.

Authorisation - This entails temporarily blocking funds in an account when card transactions are made.

- If you pay for goods with your bank card, the seller's bank receives your card data, makes a request to block the required amount and transmits this data through the VISA payment system to ProCredit Bank.

- The bank checks the card and account data (expiration date, other blocked amounts, availability of required amount) and confirms whether everything is in order with the card and whether the required amount is available in the account.

- If the card is blocked for any reason, or there are insufficient funds to cover the payment, the bank will reject the authorisation and the transaction will not be executed.

- If the authorisation goes through, the payment amount is blocked on the account and the payment is approved for execution at a later date. Blocking the funds only means that you no longer have access to these funds, even though the actual transaction has not yet been carried out. This requires the seller to perform a write-off transaction.

Debiting – This is the actual charge made to the current account, which is carried out after ProCredit Bank has received confirmation of the purchase from the seller's bank. Usually this operation takes place within a few days (maximum 30) after the payment has been authorised and the funds have been blocked. Payments between the banks are cleared at the same time.

How is currency converted when making cross-border card transactions?

Three classifications currencies are involved in the conversion process:

- Account currency - the currency of the customer’s account (MDL, EUR, USD)

- Transaction currency – the currency in which the transaction has been performed (purchase of goods or services)

- Payment currency with the payment system - the currency in which reciprocal payments between the banks take place (in the case of VISA, this is exclusively USD)

The principles of payment conversion in the international payment system

- The transaction currency is compared to the currency of the VISA payment system (USD) and if the currencies are not the same, the conversion takes place at the rate of the VISA International payment system. You can find the VISA conversion rates at the following link.

- The VISA payment currency (USD) is compared to the currency of the customer's account. And if the currencies are not the same, the conversion is carried out again using the bank’s exchange rate. The ProCredit Bank exchange rate for card transactions can be found on the main page.

- Funds are not written off from a client’s account at the time of purchase – this is carried out a few days later. Therefore, the total amount deducted from the account may be larger or smaller than the amount blocked, depending on the currency exchange rates in place when the funds are actually withdrawn from the account.

- If all currencies are the same, no conversion is necessary.

Conversion matrix when making transactions on the card

* In the case of cash withdrawals in foreign currency via ATM, the conversion occurs at ProCredit Bank’s exchange rate for card transactions